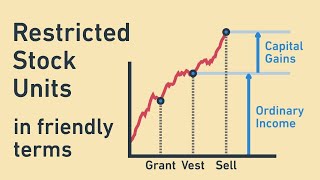

How to sell restricted stock

sell

What's the Best Time to Sell Restricted Stock Units (RSUs)?

Timecodes:

No transcript (subtitles) available for this video...

Related queries:

how to sell restricted stock fidelity

how to sell restricted stock on etrade

how to sell restricted stock options

how to sell restricted securities

how do you sell restricted stock

should i sell my restricted stock

how to sell restricted stock units

should you sell restricted stock when it vests