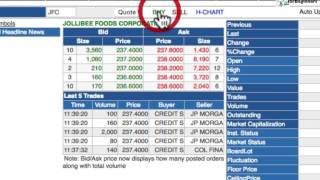

How to sell pldt stocks

sell

Getting Started: Buying, Selling, and Viewing Your Portfolio (Part 4)

Timecodes:

No transcript (subtitles) available for this video...

Related queries:

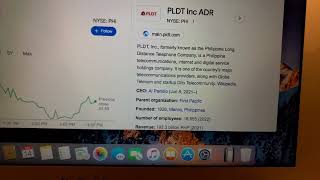

how to sell pldt shares

how to invest in pldt stocks

pldt stock price