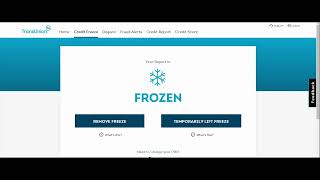

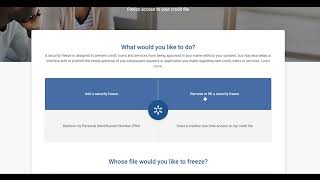

How to unlock a credit report freeze

unlock

How to Freeze Your Credit Report in 3 Minutes

Timecodes:

No transcript (subtitles) available for this video...

Related queries:

how to unlock credit report freeze

how to unlock freeze on credit

how to unlock or unfreeze credit

how to unlock frozen credit bureau